How To Avoid (Or Reduce) Cryptocurrency Gains Tax…

Want to know “How to avoid taxes on Crypto” capital gains?

There are a lot of ways you can reduce or cut your Crypto taxes with a little strategy and planning. It all depends on your specific situation, business, or personal financial goals.

Some basic ways to reduce your Crypto tax liability are:

- Tax Loss Harvesting – Maximizing tax reduction on gains by optimizing crypto losses

- Roth Self-Directed IRA/401K Strategies – To control taxes paid on gains

- Gifting, Donating Assets, Estate Planning – To reduce tax liability

- Use an Accounting Method other than First In First Out (FIFO) – to lower your tax burden

- Rebalancing vs HODL – to drive higher Crypto portfolio returns

- Take advantage of a little-known IRS allowed 0% Long term capital gains tax rate

Don’t be left in the dark about your crypto tax responsibilities, potential liability and how you can cut your crypto tax. As blockchain technology becomes more prevalent in everyday life and in the business world, the IRS will continue to increase its scrutiny of crypto-related transactions.

IRS audits on virtual currency transactions and the crack down on unreported/under reported crypto activity is projected to explode this year and over the next few years.

If you’re worried about doing your Crypto transaction accounting and tax returns yourself (or you don’t have the time or interest to do many hours of further study in Crypto taxation), you can delegate your Crypto tax burden to a Crypto specialized tax accountant.

If you want to learn how to avoid Crypto taxes, you must closely follow IRS rules in setting up your strategy. After, you must stay in compliance with the tax code. If you don’t follow the rule of law to reduce your Crypto tax, the IRS could disqualify the way you’re trying to apply tax law. If that happens you could owe back taxes, penalties and interest.

Don’t be penny wise and pound foolish in trying to avoid or lower your Crypto tax bill. Being too greedy, too aggressive and breezing-over IRS rules, could hurt your current and future Crypto wealth.

Just one moderate-level penalty for not reporting, under reporting or incorrectly reporting on your tax return (in one tax year) could easily cost you thousands of dollars! The one dollar you spend in professional Crypto tax services, could save you 2, 4, 5, 7 dollars of more in tax savings (by setting-up your strategy and following IRS requirements correctly).

How to reduce or avoid Crypto taxes on capital gains has been one of the biggest goals of my clients during my 5+ years as a Crypto tax accountant (during my 17 years as an accountant to individuals and businesses).

If you think I missed another important aspect of how to avoid Crypto tax, please add it to the comment section below. I’ll be sure to follow up with you.

If you got something out of this video (even if you knew all this info, but reinforced what you already know, or pushed you into action to get this monster conquered), please like this video and give it a thumbs up.

Do you want more step-by-step videos on Cryptocurrency taxation and how to potentially reduce your tax liability through tax planning and strategy? Then please subscribe to my channel. That way you don’t miss pending a Crypto Tax topic that personally fits your circumstances and helps you grow your crypto activities exponentially.

My free videos allow you to pick my brain and help you build Crypto wealth faster and easier than you thought possible. Thank you for watching.

Interested In Cutting-Your-Crypto Tax?

Want more information?

Let’s see if I’m a good match to help you.

Please schedule a brief call now.

It’s quick, easy and no stress!

My name is Mark Robert, and I am a crypto tax accountant and advisor. I’m going to share what I’ve learned in my 17 years of helping individuals and businesses with their crypto taxes as a tax accountant. These 18 crypto tax loopholes I’ll introduce you to will help you figure out how to avoid taxes on crypto legally.

However, you must follow the Internal Revenue Service (IRS) rules and procedures to take advantage of these strategies. If not, you could owe back taxes, penalties, and interest. So, ensure you work with a tax professional knowledgeable about cryptocurrency to use any of these strategies.

Also, remember that these strategies for avoiding paying taxes on crypto gains are for educational purposes only and may not be the best option for everyone. It’s always best to consult a crypto tax advisor before deciding what suits your unique tax situation.

Let’s get started…

How To Avoid Capital Gains Tax On Cryptocurrency

1.) Hold Your Crypto For At Least One Year

Sometimes, to avoid capital gains tax on crypto, you must hold onto your investments for at least a year before selling them. This is because the Internal Revenue Service (IRS) gives preferential tax treatment to investments held for more than a year.

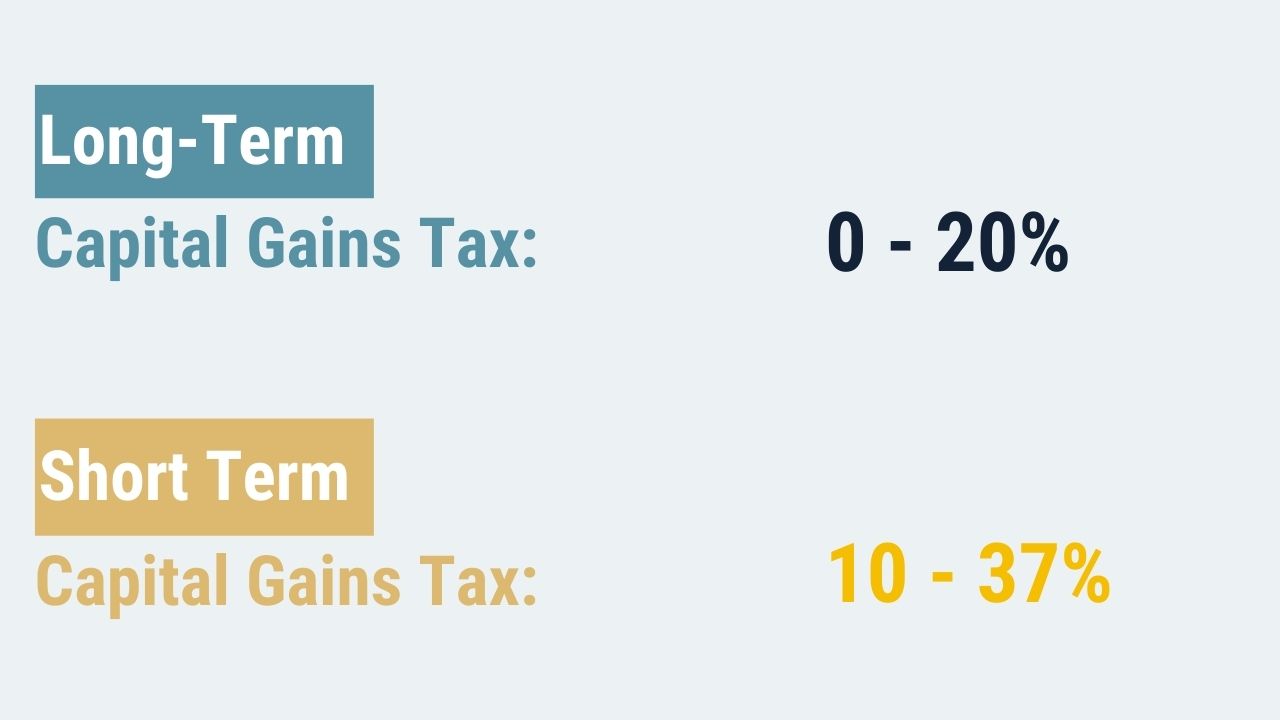

Long-term capital gains tax rates range from 0-20% (depending on your income bracket) compared to short-term capital gains tax rates, which are the same as your income tax rate (10%-37%).

So, if you’re looking for how to reduce crypto taxes, consider that holding onto your investments for at least a year can save you significant money on your taxes or allow you to avoid them altogether.

2.) Don’t Sell; hold Onto Your Crypto Long Term

If you only use fiat currency to purchase cryptocurrency without generating income, you may not have a taxable event. This method is potentially the best way to avoid all taxes on cryptocurrency, as you generally don’t owe taxes on crypto until you sell

However, it may not always be effective, as the IRS has specific rules for treating cryptocurrency transactions. So, It’s best to consult with a tax advisor to determine the best action for your situation.

3.) Hold Onto Your Crypto Until You Die; Bequeath It In Your Estate

Passing your Crypto wealth to your family’s next generation can keep your money safe and avoid paying taxes on crypto. If you don’t need access to the funds, this option is how to avoid capital gains tax on cryptocurrency safely.

When you die, your assets receive a step-up basis when they are passed on to your heirs. A step-up basis means your heirs will only pay capital gains based on the value on the day they receive them. Not a gain based on the much lower price you paid for the crypto originally.

For example: Let’s say you bought $1,000 of bitcoin today, which is worth $250,000 when you die in 20 years. If you sold the bitcoin right before you died, you’d have to pay taxes on a $249,000 gain.

However, If you pass the bitcoin to your heirs, they could sell it immediately without paying any income tax since their basis is equal to their selling price.

Ensure you arrange this inheritance and properly implement how to not pay taxes on bitcoin. Talk to a CPA specializing in crypto tax planning. If not done by the book, the IRS could recharacterize or revoke it.

4.) Use An Accounting Method Other Than First In, First Out (FIFO)

The IRS has clarified that you can use the High In, First Out (HIFO) method for tax reporting. HIFO allows you to specifically identify tax lots and sell crypto in units you paid the highest price. Often resulting in the least amount of taxable gains, leading to a lower tax bill.

This technique can be a game changer to avoid taxes on crypto. It can defer capital gains and help you reduce your crypto taxes. In fact, I’ve seen users go from having hefty tax bills to not owing anything (or even getting a refund with HIFO).

However, manually calculating these taxes can be tedious. That’s where Results Tax Accountants comes in. Our Crypto accounting software applies the HIFO method and adds proprietary accounting procedures to make adjustments based on your tax rates. This ensure you avoid taxes on cryptocurrency as much as possible.

5.) Offset Capital Gains Taxes With Capital Losses (Otherwise Called Tax Loss Harvesting)

The U.S. tax code allows Crypto losses to offset your taxable gains. If you consciously use this to your advantage, it’s called tax-loss harvesting.

Since cryptocurrencies are treated as property instead of “stocks & securities,” they are not subject to wash sale rules. This helps you sell your crypto positions in a loss situation just to harvest losses for tax purposes. Then, quickly get back into the same position without waiting 30 days (as in a wash sale).

If you have an overall capital loss for a year, you can claim up to $3,000. Any leftover loss can be carried forward to future years rolls forward to the following year. This can offset future gains or lower your ordinary income by up to $3,000 per year.

No one likes to owe money at tax time. That’s why savvy crypto investors are keen on the tax consequences of their trades throughout the year. With this strategy, they figure out how to not pay taxes on bitcoin and other cryptocurrencies. However, they work with a tax professional to maximize profits and minimize crypto taxes.

Results Tax Accountants’ tax loss harvesting dashboard can be a valuable tool for this strategy. It identifies which and how many assets you can sell off.

6.) Get Crypto Trader status

Do you want to avoid the Crypto tax limit of $3,000 capital loss maximum per year, plus get the tax deductions of a business owner?

Active cryptocurrency traders can qualify for trader tax status (TTS). In addition, there’s a potential additional tax benefit with TTS. That is, you can Elect Section 475 mark-to-market accounting (MTM) on securities and/or commodities or crypto.

Mark-To-Market Accounting (MTM)

Section 475 allows Ordinary losses to offset income of any kind, including wages. This makes them more useful than capital losses which are subject to the $3,000 capital loss and wash sale loss adjustments on securities.

Trader Tax Status (TTS)

Trader Tax Status allows you to deduct trading business expenses. This includes home office expenses, education/travel expenses, computer equipment, automobile, and other expenses required in your ordinary business activities. (If legitimate trading business expenses, the tax savings could be big.)

A TTS trader can also write off health insurance premiums and retirement plan contributions by trading through an S-Corp with officer compensation. Trader Status and 475 Mark To Market Status are subject to several strict rules. So you should consult a qualified Crypto accountant to ensure you comply with the eligibility rules each year.

7.) Lower Your Taxable Income

If you want to learn how to avoid paying taxes on crypto, you can scour the tax code for tax deductions and credits that bring your taxable income down.

Here are a few tricks to help you:

- Take advantage of expensive tax-deductible medical procedures

- Contribute to a traditional IRA or 401(k) plan.

- Put money in a health savings account.

- Donate cash or property to charity,

- Take business deductions and Home mortgage interest deductions

All of this will lower your taxable income. However, there are plenty of other tax deductions and credits that you may qualify for. And you shouldn’t be missing out on tax savings you may be entitled to. So, find a tax professional who can help uncover all the tax breaks and credits you may not know about.

8.) Sell In A Low-Income Year

Your tax rate on capital gains from cryptocurrency, whether short-term or long-term, is based on your overall income in a given tax year. Therefore, if you can lower your taxable income, you can reduce your tax rate.

One way to do this is by selling cryptocurrency that you expect will generate taxable gains in a year or years when your income is lower. This strategy could reduce your crypto tax burden on short-term and long-term gains. Especially because long-term capital gains tax rate that applies to you (0%, 15%, or 20%) is based on your taxable income.

9.) Gift The Assets To A Family Member

Depending on your goals and wealth, consider reducing your crypto tax bill by gifting your cryptocurrency to family members. Gifting cryptocurrency can help you avoid capital gains tax on cryptocurrency. The recipient won’t have to pay a gift tax, either.

Under current rules, you can give up to $15,000 per person annually without filing a gift tax return. The recipient of the cryptocurrency will need to know your basis in the cryptocurrency to determine the tax they owe when they eventually sell it. Of course, they will have to pay tax on the entire gain above your basis. But that tax will likely be less than you would pay if they were in a lower income tax bracket.

This could be an option if you help one of your children (who often has a lower income tax bracket) pay expenses like college tuition.

Rather than using “after-taxable crypto gain funds,” you could gift the funds to someone else who pays a lower tax rate. But it’s always best to double-check with your tax advisor to ensure it’s part of your overall plan. That way, you’ll end up keeping more of your hard-earned money.

10.) Donate Your Appreciated Cryptocurrency To Charity

Donating crypto to IRS-recognized non-profits or charities is not subject to capital gains taxes and can be tax-deductible. Under many circumstances, your donation can offset 30 to 50% of your ordinary income.

However, there are many moving parts and steps to ensure you do this correctly. Something as simple as failing to complete a “contemporaneous written acknowledge” in writing within a reasonable amount of time that states you received no goods or services in your donation can result in your entire donation being revoked and disallowed later by the IRS.

11.) Buy, Invest, And Trade Crypto In A Self-Directed Individual Retirement Account

Self-directed IRAs or 401Ks are special retirement accounts. They allow you to invest in unique assets like cryptocurrency, precious metals, and real estate. Regular IRAs or 401ks do not allow assets like cryptocurrency.

To avoid capital gains tax on crypto, open a self-directed IRA or 401k (traditional or Roth) and start making contributions. However, you can also roll over an existing IRA or retirement plan into a self-directed traditional or Roth plan.

In a Roth, you contribute “after-tax” paid funds. The assets can accumulate in value without any capital gains tax owed as it compounds. You do not have to pay any tax on a ROTH when you withdraw it in the future. So, this is huge.

Since you must use after-tax money to fund a Roth, if you decide to convert a current traditional 401k or IRA to a ROTH, you must pay a tax on all previous tax-deferred retirement funds.

However, you can minimize crypto taxes as follows:

ROTH

When the crypto market is down, and prices are low, you can sell or transfer the funds to a ROTH self-directed IRA or 401k. Paying taxes on the traditional retirement fund to Roth conversion when crypto prices are low will result in less tax. This is because the current value of the rollover funds or assets in it is lower.

Then if crypto prices take off again and return compound, you will get tax-free gains and withdrawals for life on the same funds or crypto as prices rise again. Then, of course, for any crypto you buy within a ROTH, you pay zero tax on the capital gains earned in the account.

Traditional IRA

If you buy cryptocurrency inside a traditional IRA, you will defer tax on the gains until you begin to take distributions. Although you can only partially avoid crypto taxes on traditional IRAs or 401Ks, the biggest advantage of an SDIRA is that you get to compound crypto profits in your portfolio without having to pay taxes on them today.

Not having to pay taxes on trades today means you get to use tax money, which would have gone out to the government if you traded in a non-SDIRA account, to compound profits. Moreover, if you take out the funds at retirement and have a lower tax rate, you also get tax savings from there.

Trying to figure out how to avoid capital gains tax on crypto should be done carefully, so you don’t run into any IRS-prohibited transactions that could cause problems. In addition, working with a tax professional ensures you’re up-to-date on the latest regulations, so this strategy will not backfire on you.

Some self-directed plans have pricey fees and limit your crypto and other investment choices. Others have low fees and give you the freedom to do what you want.

So which self-directed IRA and 401k companies are the best for fees and freedom to make crypto investment choices? I’m familiar with several highly reputable Self-Directed IRAs and 401 Ks that have low fees and allow you to choose which Cryptocurrencies you want to invest or trade.

Contact me for the best options and how to do this correctly before you do anything.

12.) Move To Puerto Rico

US citizens are taxed on worldwide income. Therefore, no matter where you live, US citizens must pay US tax on our capital gains, including gains from cryptocurrency. The only exception to this rule is found in the US territory of Puerto Rico.

Puerto Rico makes its tax laws for residents and offers any tax breaks deemed appropriate. In addition, the territory is excluded from federal taxation and can help you avoid Crypto taxes.

Moving to Puerto Rico allows you to pay a 0% capital gains tax as an American. It’s a great way to enjoy tax-free profits from trading and investing in cryptocurrency. All qualifying residents can reap the rewards.

“A resident of the territory is any US citizen who spends at least 183 days a year on the island”. (This could include a few other rules for specific individuals)

The Puerto Act

Puerto Rico’s Act 60 promotes investment in Puerto Rico through tax incentives. These tax benefits include zero tax on passive income, including capital gains, dividends, and interest.

Other tax benefits from Act 60 include:

- A low 2-4% corporate tax.

- 4% income tax.

- 75% tax exemption on state property taxes.

- 50% tax exemption on municipal taxes.

NOTE: This strategy is extremely complex, so you should consult a Crypto tax accountant before making a move.

Puerto Rico is America’s tax haven, but recent spikes in the cost of living will diminish crypto tax savings. So, the location is best for crypto whales. If you’re not a crypto whale yet, your best tax/cost of living offset is usually moving to a lower tax U.S. state that also has a lower cost of living.

The key is to drive your income up and your expenses down (whether that is tax expenses or living expenses). Then, you can choose a tax-friendly ZIP code and/or lifestyle.

13.) Move To A State With No Income Tax

Not just the IRS, your state wants to collect taxes from your crypto gains too. So, moving to a state without an income tax is an attractive and smart tax move. Nine U.S. states have no income tax as of 2021. (Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming)

Some states may have no or low-income tax but very high property tax rates or other taxes that could offset benefits to “no income tax” status. Therefore, don’t just look at no zero-income tax states. Instead, consider the full tax and cost of living expense picture when researching how to avoid taxes on crypto.

For example, owning a home is often one of the biggest investments for many of us. But, along with that comes one of the greatest tax liabilities – property tax.

Property taxes have risen astronomically in many U.S. states, but not because of a property tax rate. States that might have a low or moderate property tax rate can have huge property tax bills because the cost of your average home is much higher. For example, California has a property tax rate of about 1%, but due to the very high cost of home prices can result in a very high property tax rate.

14.) Move Out Of the US

In many parts of the world, cryptocurrency is tax-free. Unfortunately, this doesn’t apply to US citizens. We still have to pay taxes on our worldwide income, including cryptocurrency gains. This makes it more difficult for US taxpayers to figure out how to avoid Crypto taxes.

However, as we already covered, it’s about lowering your overall financial expenses, including the cost of living. But since tax is normally your biggest expenses burden in life and your crypto life, that’s our focus.

Several countries offer a high quality of life at a significantly lower cost of living than the United States. These countries may also be safer and offer a unique and exciting lifestyle for those who are open to new experiences. If you want to reduce expenses such as taxes, you should consider moving to one of these countries.

Foreign Income Exclusion

If you are a U.S. citizen or a resident alien of the United States and live abroad, you are taxed on your worldwide income. However, you may qualify to exclude your income (while living abroad) up to an amount adjusted annually for inflation by living outside the US for a portion of each year. This amount is $112,000 at the time of this recording.

To take advantage of this strategy of avoiding crypto taxes, you must be a U.S. citizen or a U.S. resident alien who is physically present in a foreign country or country for at least 330 full days for 12 consecutive months. For example, your foreign income while living outside the US could be: a professional trader/investor or other business activity like freelancing, e-commerce, working as an employee, etc.

Change Your Country of Citizenship, Get A Second Passport and Renounce Your US Citizenship

Would you give up your citizenship simply to avoid Crypto tax and all other types of tax? This is the most dramatic of all methods on how to not pay taxes on crypto.

If you expatriate, the IRS may no longer have the right to tax your earnings as a US citizen. However, it’s important to remember that US citizens are generally required to pay US taxes on their capital gains and cryptocurrency gains regardless of where they live.

For example, if you move to Panama but keep your US passport, you may still be required to pay US taxes on your cryptocurrency trading profits. The only way to permanently sever ties with the IRS is to turn in your US passport and obtain citizenship in another country.

Here are 13 Countries that do Not tax cryptocurrency or have extremely favorable taxation on crypto:

- Belarus.

- Bermuda.

- British Virgin Islands.

- Cayman Islands.

- Germany.

- Gibraltar.

- Hong Kong.

- Malaysia.

- Malta.

- Portugal.

- Singapore.

- Slovenia.

- Switzerland.

You have many choices when it comes to getting a second passport. You can buy one from countries like Malta ($1.2 million), Dominica ($120,000), or St. Lucia ($500,000 investment). Or you can earn one over time by becoming a resident of a foreign country.

Additionally, there are other countries that are extremely crypto-friendly. You should keep your eye on these options in deciding how to avoid Crypto taxes.

One country may tax cryptocurrency and/or have other taxes that offset the benefits of no tax on crypto. Therefore, it’s important to discuss this with a tax advisor. Tax laws also change constantly, so you need to stay updated on any changes.

15.) Buy Cryptocurrency In Your Life Insurance Policy

Another way to pay zero tax on cryptocurrency gains is to buy coins with an international life insurance policy. For example, you can fund an Offshore Private Placement Life Insurance and create the equivalent of a ROTH or Traditional IRA. There are no contribution limits or distribution requirements.

Most offshore private placement policies require a minimum investment of $1.5 or $2.5 million. However, if you set up a private placement policy, hold it for a few years, and then close it down, you get a tax deferral similar to a traditional IRA. That is, you’ll pay tax on the gains when you close out the policy.

If you hold the policy until your death and pass the cryptocurrency to your heirs, you get tax-free similar to a ROTH IRA. However, because of the step up in basis, your heirs receive the coins at their price on the date of your passing and pay zero tax on the appreciation while they were held in your life insurance policy.

16.) Take Advantage Of A 0% Long-term Capital Gain Tax Rate

The US tax code has a relatively less known 0% tax rate for long-term capital gains. This is one of the simplest ways to figure out how to avoid capital gains tax on cryptocurrency.

The eligibility for this 0% tax rate depends on your filing status, your annual income, and how long you kept the cryptocurrency before selling it. If you are married and filing jointly, you could make up to the $83,350 (married filing jointly) (at the time of this recording) in crypto profits without being subject to any taxes.

17.) Roll Over Crypto Profits Into Opportunity Zones (OZs)

This strategy to avoid tax on Crypto gains is well suited for sophisticated high-net-worth taxpayers with many unrealized cryptocurrency gains. The federal government has created a set of tax incentives for investment in economically distressed areas.

Tax savings come in three forms: tax deferral, tax reduction, and tax elimination. Basically, you would roll over your long-term crypto profits into a Qualified Opportunity Fund (QOF). Then, the QOF fund would invest that money in economically distressed areas designated by the government.

- If you were to hold your investment in the QOF for at least five years, 10% of your initial crypto tax gain would be tax-free.

- Holding your investment in the QOF for at least seven years makes an additional 5% of your initial crypto tax gain would tax-free.

- Finally, if you were to hold your investment in the QOF for ten years, you could completely avoid capital gains taxes on the appreciation of QOF stocks in addition to the tax savings triggered in years 5 and 7.

This ability to completely eliminate taxes on the appreciation of QOF stock is one of the biggest tax-saving opportunities in the tax code.

18.) Consult A Crypto Specialized Tax Accountant

Most of the ways discussed to avoid paying tax on cryptocurrency are very effective. However, each strategy has numerous strict rules and procedures that must be adhered to. This ensures IRS or state tax authority does not disqualify how you apply the tax reduction strategy.

Work with a Crypto tax professional to ensure you comply when applying the IRS tax code to your situation. Sometimes the dollar you spend to set these strategies up “the correct way” can save you much more in taxes. In addition, you get the confidence and peace of mind knowing all your tax reduction is airtight and will stand up to an IRS examination or audit.

I help clients complete and file their crypto tax returns and crypto accounting, do tax planning, and provide ongoing monthly/quarterly tax compliance and tax reduction coaching. If you have any questions on how I may be able to help you avoid paying taxes on crypto. Don’t hesitate to reach out to set up an appointment.

Interested In Cutting-Your-Crypto Tax?

Want more information?

Let’s see if I’m a good match to help you.

Please schedule a brief call now.

It’s quick, easy and no stress!