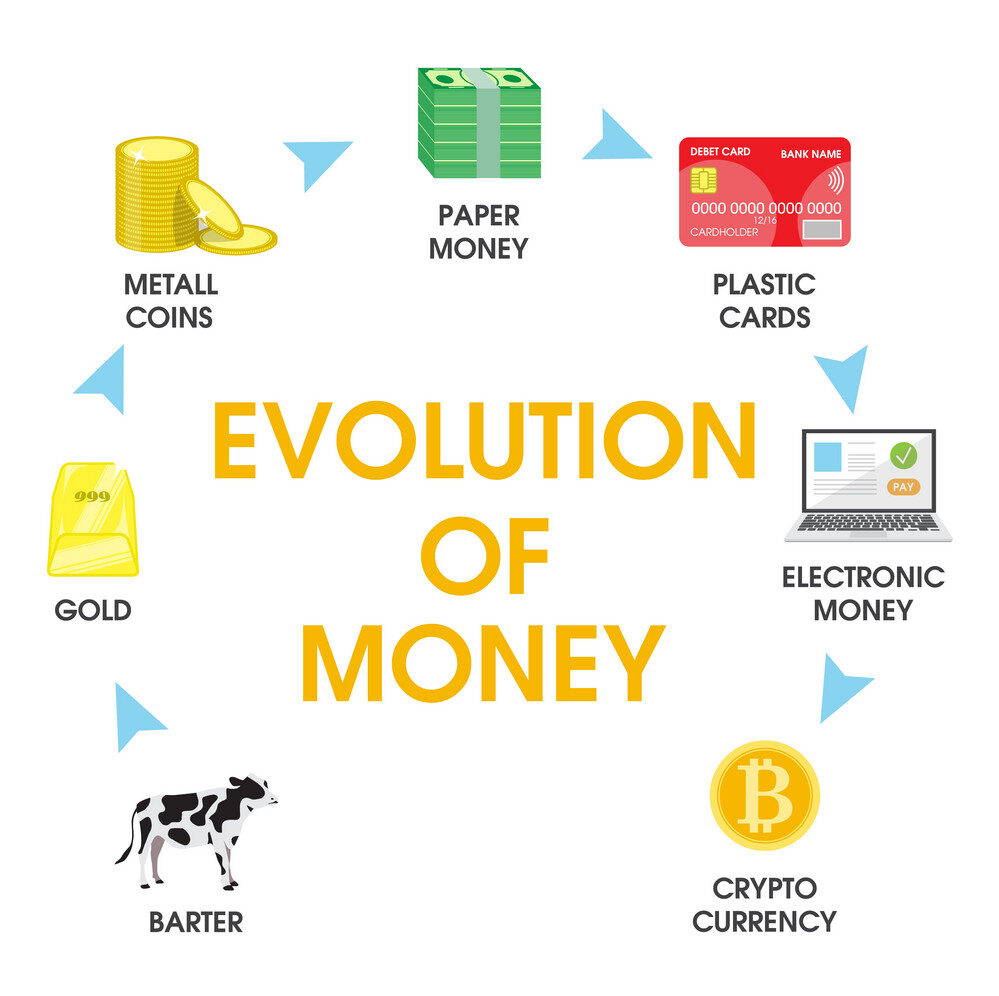

My name is Mark Robert Buckingham, Crypto Tax Accountant and Advisor. I currently hold the Advanced Crypto Tax Expert (ACT-E) professional designation.

Prior to my 17 years as a tax accountant (and 5 years as a Crypto tax accountant)…

…I was a CEO of a fast-growing company in the test prep industry. I too was in search of a business and personal tax accountant (or CPA).

You see, 23 years ago I discovered small changes to what I was already doing with proper tax planning could legally and ethically reduce my tax burden each year.