Crypto taxes can be confusing, especially with the irregular price actions, airdrops, forks and other factors that come into play.

And worst, you have terminologies, regulations, and filing procedures that are so different from your everyday tax filing processes.

Fortunately, there are a few efficient and reliable solutions that you can use to make sure your crypto taxes are properly filed.

This article will answer a common question:

Can you use TurboTax for crypto tax preparation? And if yes, what do you need to know, and how can you use it?

In the following sections, we’ll answer these questions and provide you with almost everything you need to know about using TurboTax for your crypto taxes.

Let’s go.

What Is A Good Cryptocurrency Tax Preparation Solution?

Before we move on to the specifics of filing cryptocurrency taxes with TurboTax, let’s first talk about what a good crypto tax filing solution should be.

Ideally, it should allow you to:

- File your crypto taxes without any hassles

- Accurately calculate your taxable gains and losses

- Provide you with an audit trail of all your transactions

- Help you easily access relevant tax forms and documents

- Offer reliable customer support to help address any issues

6 Questions to Answer Before Using TurboTax For Crypto Tax Prep…

Now that you know what to look for in a good crypto tax filing solution, let’s consider whether TurboTax is the right option.

To help decide that, here are six questions to answer:

#1.) What Type Of Crypto Transactions Do You Make?

The type of transactions you make will impact your crypto tax filing process.

For instance, if you buy and hold cryptocurrencies, then using TurboTax for cryptocurrency should be straightforward.

However, if you frequently trade, use DEFI, mine, or run a web3-based business, you can still leverage TurboTax for your crypto taxes, but it gets complicated.

You’ll need to track your cost basis and determine how long you held each asset to accurately calculate your gains and losses.

Also, with new projects and platforms popping out daily, how can you seamlessly export your trades and transactions to TurboTax? If not, are there tools you can leverage to do that?

Of course, these don’t make TurboTax an impossible option. Still, it just means that you’ll need to do your due diligence and ensure that the product is right for your particular needs.

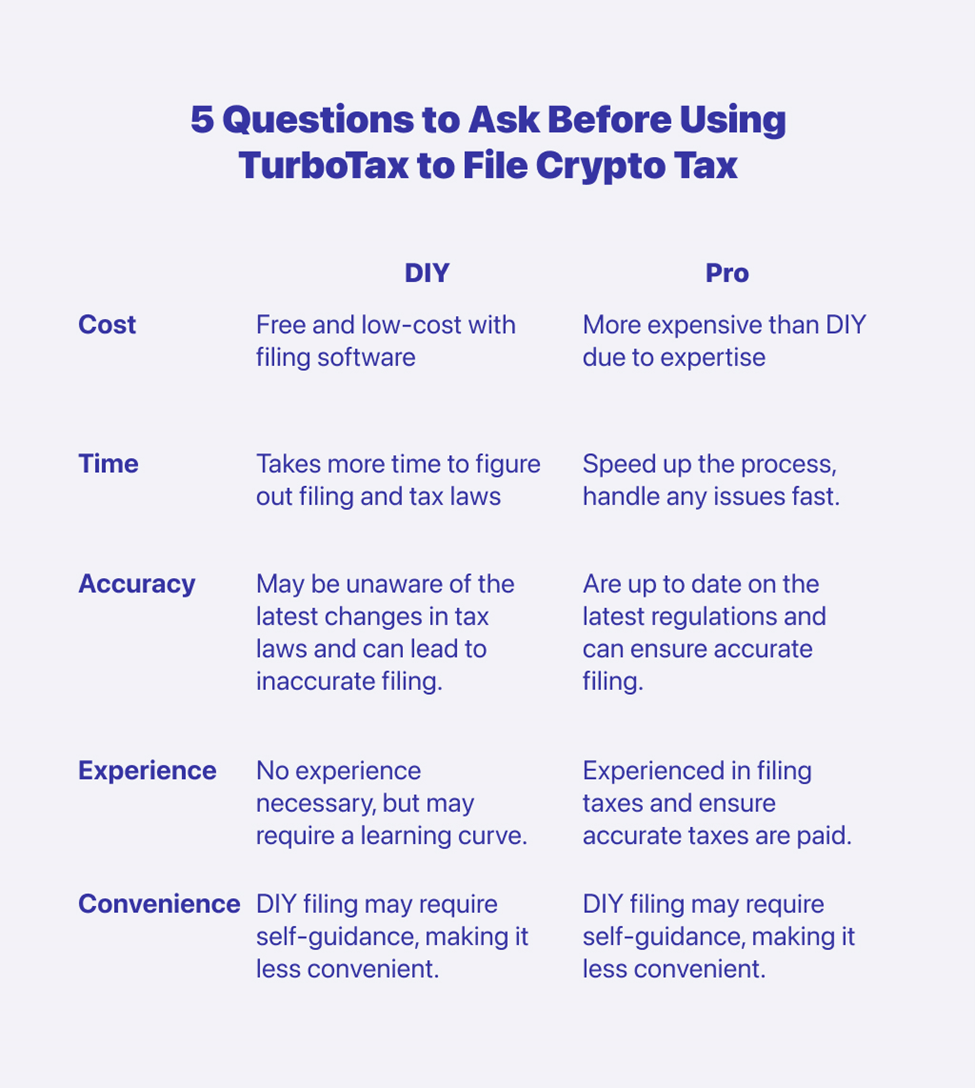

#2.) Should You Prepare And File Your Own Crypto Taxes Or Use A Professional?

Tax regulations for cryptocurrencies vary from state to state, and you can find yourself in deep trouble if you omit even a single detail.

If you’re an experienced crypto trader, filing your taxes yourself can be a viable option. Still, you need to understand the tax terminologies and regulations around cryptocurrency assets and the filing process.

Therefore, it’s important to know the right filing procedure and the applicable regulations in your region, or else you risk getting audited by the tax authorities.

For instance, do you know the ins and outs of capital gains tax or the differences between long-term and short-term losses?

Some traders try to save costs by filing taxes themselves, only to end up with a hefty fine or worse—a criminal case.

Example, John trades on multiple exchanges and holds a variety of coins. He tried to file his crypto taxes with TurboTax, only to find out that he omitted details about his forks and airdrops.

In the end, despite saving some money, John ended up paying more in fines than he would’ve if he used an accountant or professional tax service.

It’s always advisable to work with a certified crypto tax preparer who can help ensure that all your taxes are in order and filed properly.

You can leverage a crypto CPA, crypto accountant, an enrolled agent or an online crypto tax service that can help you file your taxes with TurboTax and other services.

Most companies handle virtually all aspects of the filing process for a fee so that you can focus on trading. At the same time, they take care of the tax paperwork.

Note: TurboTax allows you to outsource your filing needs to an accountant or tax expert.

If you’re outsourcing, you can stop reading here and see our articles on questions to ask your tax accountant. Next, schedule a call with the tax expert, and leave the rest to them. Otherwise, continue reading to learn how to use TurboTax for your taxes.

#3.) Can You Access Your Trade History Easily?

This tip/solution does not have anything to do with TurboTax. Regardless of whether you use an accountant or tax service or TurboTax. “Accessing your trade history” and having records/data is a legal requirement of IRS.

This is one of the most critical questions when using TurboTax for your crypto taxes.

You need to be able to access all your trades and transactions without any hassle. That way, you can accurately track your cost basis and other information that will help you determine your gains and losses.

If your transactions are scattered across multiple platforms, getting an overview of the big picture can be tough.

Sometimes it requires you manually upload the trade data. This can be time-consuming, and there is a risk of making mistakes when manually entering your data into TurboTax.

Or better, you leverage portfolio management tools like CoinTracker or CryptoTrader.Tax. Crypto tax accounting software like these allow you to aggregate all your trades in one place and export them into TurboTax with a single click.

Once you have all the information prepared, you can use their APIs or CSV export options to feed your tax filing software and ensure that everything is accurate and up-to-date.

What is the best crypto tax accounting software for TurboTax? Most of them integrate with Intuit’s tax preparation software. Therefore, the answer to the “best cryptocurrency accounting software for TurboTax” comes down to personal preference.

#4.) Do You Know How To Calculate Your Gains And Losses?

Another important question when using TurboTax for crypto taxes is whether it can calculate and report your gains and losses.

Unfortunately, the answer to this is no; TurboTax cannot generate a Schedule D or Form 8949 that captures all relevant details about your crypto trades and activities.

You can leverage third-party crypto tax accounting software (like mentioned above) to generate these documents and import them into TurboTax. This will ensure that you accurately calculate and report your gains and losses.

Beyond that, you need to be aware of the tax treatment for various crypto transactions, including cryptocurrency exchanges and airdrops. (discussed soon)

What’s the tax implication of forks, airdrops or staking rewards?

You also need to understand how to handle tax implications for hard forks, airdrops, or staking rewards. Fortunately, plenty of online resources can help you understand the basics of crypto taxes.

If you still need clarification, you can consult a professional tax accountant to help you with your filing needs.

#5.) Are You Prepared For An Audit?

Tax audits are an inevitable part of filing for crypto taxes. You’re susceptible to heavy consequences like fines and penalties if you owe taxes and fail to report them correctly.

Filing your crypto taxes with TurboTax won’t give you a lot of protections against and audit. You won’t be able to call TurboTax for crypto tax and accounting help if the IRS wants to examine your tax returns more closely. Only an professional accountant will be in corner and deal with the IRS if questions or issues arise.

To prepare for an audit, ensure you keep all trading records handy in case of a dispute. That way, you can provide evidence to show that your tax filings are accurate and compliant with the law.

To be fully prepared for an audit, you’ll need your trading records organized and easily accessible in case a dispute arises. This is critical as you’ll need documentation to prove that your tax filings are accurate and meet legal requirements. And even in some cases, you may need to prove that specific trades or transactions were made.

But there’s a simple way to avoid the hassle and stress of an audit—use a CPA or a tax preparation service that’ll stamp your returns as “audit-proof.”

A professional tax accountant can help you with the filing process and prepare your taxes to minimize the risk of an audit, and it works almost every time.

#6.) How Much Is Your Time Worth? And How Does It Reflect The True Cost?

Time is money, and filing taxes can take up much of it.

This a question you need to ask yourself when deciding whether or not to use prepare your cryptocurrency tax return with TurboTax. Are you willing to spend hours inputting your data, researching tax laws, and crunching numbers?

Or would it be better to outsource all your filing needs to a professional accountant or tax expert?

Don’t calculate the monthly premium you pay to TurboTax as the only cost associated with filing your taxes. You also need to factor in your time investment and the opportunity cost of not working on other activities that could bring you more money.

Now that you know the questions to ask yourself, decide if filing your crypto tax return with TurboTax is the best solution.

If it’s not, there are plenty of other options available. You can check our guide to find the best crypto tax solutions.

11 Tips and Tricks For How To File Crypto Taxes On TurboTax …

#1.) Familiarize Yourself With The Software

Before getting started, take some time to go through TurboTax and learn how it works. This will help you understand the user interface and navigate the tax filing process easier.

Use youtube tutorials or practice filing dummy crypto tax returns with TurboTax before you tackle your taxes.

Doing this will save you plenty of time and frustration throughout the process.

#2.) Gather All Your Required Information And Documents

To file your taxes accurately, you need to have all the necessary information and documents at hand. This includes trading history, bank statements, wallet addresses, and other documents related to your crypto activities.

Make sure all your records are organized and up-to-date before starting your filing. This will make the process smoother and more efficient.

Also, double-check to ensure that all your transactions have been accurately recorded so that your tax filing is accurate.

#3.) Automate What You Can

If you want to use TurboTax for crypto, you can import transactions easily from popular exchanges like Coinbase and Binance. This will save you time and effort as all your trading data is extracted automatically.

But you’ll leverage third-party solutions if you use other exchanges or wallets that TurboTax doesn’t support.

At all costs, avoid manual data entry as much as possible. Manual entry is the fastest way to make mistakes and cause frustration during your filing process.

You can hire an automation expert for a one-time fee or do it yourself using an API integration service.

#4.) Max Out Opportunities For Deduction And Tax Credits

Crypto taxes can be tricky. But with TurboTax, you can take advantage of deductions to lower your tax bill.

Research and identify all the deduction opportunities available to you. This includes losses, charitable donations, trading fees and other expenses related to your crypto activities.

Keep all supporting documents if you get audited by the IRS.

#5.) Determine Your Crypto Cost Basis Method Upfront

Before you starting entering your crypto gains and losses into TurboTax, you must have your transaction accounting reconciled and accurate.

The IRS allows you to calculate your capital gains and losses using different methods:

- First in First Out (FIFO): the first asset purchased is the first one sold.

- Last in First Out (LIFO): the last asset purchased is the first sold.

- Highest In First Out (HIFO): the asset with the highest cost is the first sold.

- Minimization Method: select the sale(s) that minimize realized gains.

- Specific Identification: match specific transactions with specific gains/losses.

These significantly affect your taxes.

For instance, in a scenario where you purchase 1 BTC at $10,000 and another at $15,000 and then sell one at $20,000 each. Using the FIFO method, you would have a taxable gain of $10,000, while the LIFO method would leave you with a gain of $5,000.

You can see how this quickly affects your taxes when you trade high volumes.

And why should you choose one method upfront? You can only use one method for your entire tax year, and changing it may land you in hot water with the IRS.

So make sure you understand which method is best for your situation and, in most cases the one that allows you to pay the least amount of taxes.

#6.) Know Taxable And Non-Taxable Events

Unfortunately, when it comes to using TurboTax for cryptocurrency there’s a lot that the software can’t help you with. There is no substitution for knowledge of tax law, cryptocurrencies and having vast experience in tax preparation. A tax prep software will never maximize all deductions or tax credits you are legally eligible to take. A tax preparation app will not be able determine how tax should be (or NOT be applied) to your specific situation and circumstances.

Plus, not all crypto transactions you may enter into the software are taxable! (Expensive “do it yourself mistake!”)

Taxable transactions include:

- Buying and selling crypto trading one coin for another.

- Receiving payments in the form of cryptocurrency.

- Receiving hard forks, airdrops, or other crypto distributions.

- Trading DEFIs and making profits or loss from your crypto holdings.

- Converting crypto to fiat.

Non-taxable transactions include:

- Gifting cryptocurrency up to $15k.

- Donating cryptocurrency to a charity.

- Buying goods and services with crypto and not receiving any changes.

- Transferring crypto between wallets.

Make sure you understand the difference between these two categories. This will help you accurately report your taxes and avoid underpayment or overpayment.

#7.) Leverage Crypto TurboTax Resources And Help Center

The good news, TurboTax has a comprehensive help center with easy-to-follow tutorials and FAQs.

The best part about the help center? It’s customized for crypto. That means you get answers to all your crypto-related questions quickly and easily.

You can also leverage their live chat support team to get personalized assistance with your filing process.

So if you use TurboTax for preparing your crypto tax, make sure you’re leveraging their resources and help center to file correctly and avoid errors.

Turbo Tax For Crypto FAQs:

Q: Is TurboTax the best way to file my Crypto taxes?

A: It depends on your situation. For some people, TurboTax is a decent way to file crypto taxes. It’s easy to use and offers resources like a help center and live chat support.

Q: Should I use an accountant?

A: If you have a complex financial situation or are filing for business income, it’s best to consult an accountant. They can help ensure you file accurately and maximize your deductions.

Q: Does TurboTax provide audit support?

A: Yes, TurboTax provides limit audit support if you get audited by the IRS (only under tight rules and limitations, in reality you’re on your own). However, keeping all your records and documentation for at least three years is important in case the IRS wants to review them.

Q: Is my data secure with TurboTax?

A: Yes, TurboTax uses bank-level security and encryption to ensure your data is safe. They also adhere to the highest industry standards for privacy and security.

Q: How do I upload my 1088-K to TurboTax?

A: You can easily upload your 1099-K form to TurboTax by following the onscreen instructions. You’ll need to have the form downloaded from your exchange or wallet.

Conclusion

Filing crypto taxes with TurboTax is OK if you have a straightforward financial situation. You can DIY your crypto tax if you understand trade lightly and the filing basics.

However, if you trade frequently, leverage DEFI, bag airdrops, invest in presales or have complex financials, it’s best to use the tax prep services of a professional crypto accountant.

Remember to leverage TurboTax resources and the help center to file correctly. Good luck!